Summary

- Compounding in Bonds: Compounding in bonds involves reinvesting interest earned to increase total returns.

- Economic Cycles: Bond performance varies with economic cycles, affecting interest rates and bond prices.

- Types of Bonds: Government, corporate, municipal, and high-yield bonds offer distinct compounding potential and risks.

- Maximizing Returns: Reinvesting interest and selecting bonds with favorable interest rates or maturities can enhance compounding benefits.

How Compounding Grows Your Investment Over Time

For many investors, bonds are a safe and reliable way to grow wealth over time. However, the real secret to building significant wealth through bonds lies in compounding, where interest payments are reinvested to generate even more interest. This cycle of reinvestment grows wealth incrementally, turning bonds into a powerful financial tool.

We explore how compounding works in bond investments, different types of bonds, strategies to maximize your returns, and how economic cycles impact bond performance. Whether you’re a beginner or an experienced investor, understanding the power of compounding in bonds can help you achieve long-term financial goals.

1. Compounding in Bonds: How it Works

Compounding in bonds occurs when you reinvest the interest payments (known as coupon payments) you receive, allowing them to generate additional income. Bonds generally pay interest at regular intervals, which can be monthly, quarterly, or annually. By reinvesting these payments, you’re able to increase your investment’s value over time, as each payment begins to earn its own interest.

Example of Bond Compounding

Suppose you invest in a bond with a $1,000 face value and a 5% annual interest rate. In the first year, you receive $50 in interest. If you reinvest this $50 into another bond or reinvest it within a compound bond fund, this $50 will also start earning interest. Over time, this process accelerates wealth growth, as each interest payment earns its own interest.

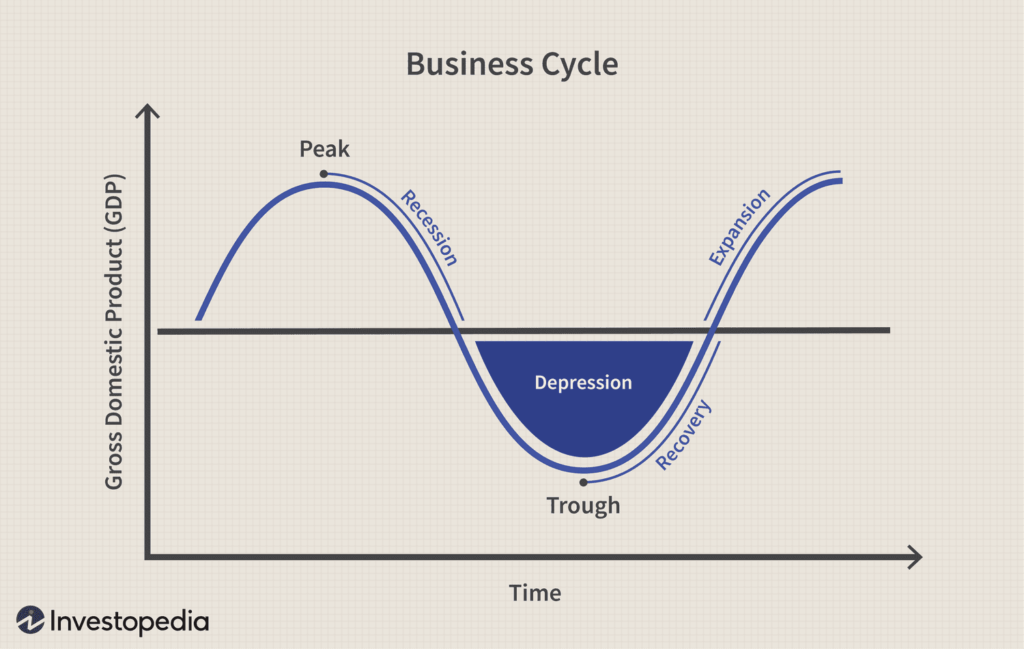

2. Economic Cycles and Compounding: Timing Matters

Bond investments are sensitive to economic cycles, particularly because interest rates fluctuate with economic conditions. Understanding these cycles helps in selecting bond that maximize compounding opportunities.

Expansion Phase

During economic expansion, interest rates often rise as the demand for borrowing increases. In this phase, bond prices might drop, but new bonds issued offer higher yields. This is an ideal time to reinvest your interest in higher-yield bond to take advantage of the compounding effect.

Contraction Phase

In a contraction or recession, central banks often lower interest rates to stimulate the economy, which increases bond prices. Bonds with higher yields issued before the contraction become more valuable, and reinvesting interest payments can generate significant returns in this low-interest-rate environment.

Recovery Phase

As the economy recovers, interest rates may begin to rise, affecting bond prices again. At this stage, investors can consider shifting interest earnings to bond that offer higher yields or shorter durations, allowing flexibility as rates change.

3. Types of Bonds for Compounding Opportunities

Different types of bonds provide various compounding benefits, depending on their risk levels, interest rates, and durations. Here are the primary types of bonds that investors often use to create compounding growth.

Government Bonds

They are issued by national governments, are usually low-risk and provide stable returns. In Kenya, for example, Treasury bond are a common investment choice. These bond offer regular interest payments, which can be reinvested for compounding. Due to their low risk, government bond are ideal for conservative investors looking for steady, compounded growth.

Corporate Bonds

Issued by companies to raise capital, they generally offer higher interest rates than government bond. Corporate bond allow investors to compound at a faster rate but come with more risk, as companies may face financial challenges that affect bond performance. Choosing bond from established companies can provide a balance between higher yields and compounding potential.

Municipal Bonds

They are issued by local governments or municipalities and are often tax-exempt. These bonds typically offer stable returns, making them suitable for compounding strategies. For those seeking a reliable income stream with tax advantages, municipal bond provide a compounding opportunity with relatively low risk.

High-Yield Bonds

Also known as “junk bonds,” high-yield bond offer the highest interest rates to compensate for their higher risk. While they can accelerate compounding with attractive yields, they are more susceptible to default, especially during economic downturns. Investors seeking growth through compounding should balance high-yield bond with more stable bond types to manage risk effectively.

4. Maximizing Compounding Returns in Bond Investments

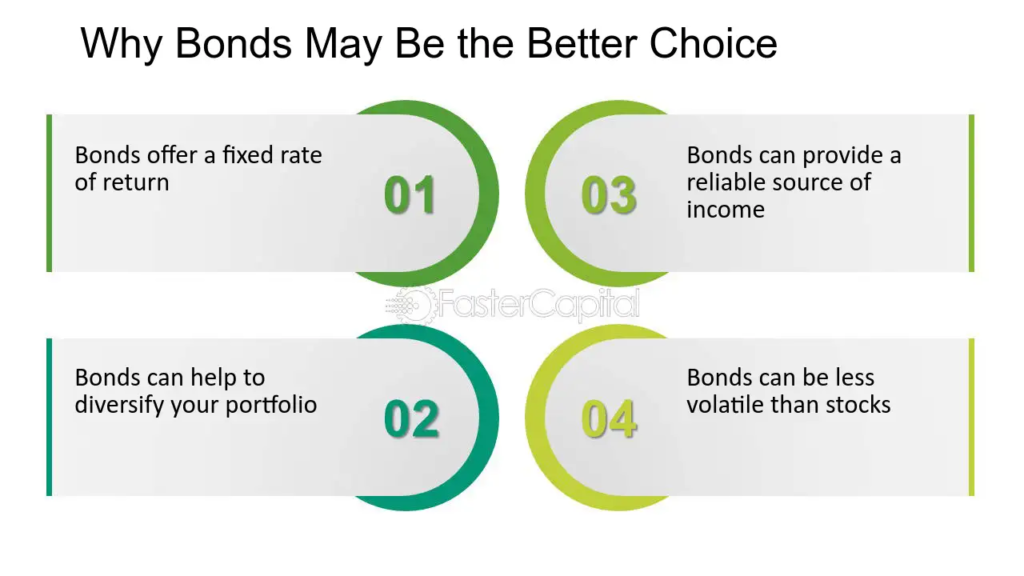

Achieving strong compounding returns with bonds requires a strategic approach, including reinvesting interest, choosing bonds with favorable terms, and diversifying your bond portfolio.

Reinvesting Interest Payments

The cornerstone of compounding in bonds is reinvesting interest payments. By reinvesting every coupon payment, you’re essentially growing your capital base. Many bond funds automatically reinvest interest for you, while individual bondholders can manually reinvest by purchasing additional bonds or using compound bond funds.

Select Bonds with Favorable Maturity Dates

The maturity date of a bond (when it will pay back the principal) impacts compounding opportunities. Shorter-maturity bond offer flexibility for reinvestment when rates are favorable, while longer-maturity bond lock in yields for extended compounding but can be sensitive to interest rate changes. A mix of both can help you compound effectively across different market conditions.

Diversify Across Bond Types

Diversifying across bond types, such as government, corporate, and high-yield bonds, provides a balanced approach to compounding. Diversification helps you navigate different economic phases and reduces risk by spreading your investments across various bond categories.

Leverage Bond Funds for Compounding

Bond funds pool multiple bond together, distributing returns to investors. Many funds offer compound options, where interest earnings are automatically reinvested. These funds make it easy for investors to benefit from compounding without the hassle of purchasing individual bond repeatedly.

5. Compounding Bonds in Kenya’s Financial Landscape

In Kenya, bond investments—particularly government Treasury bond—are increasingly popular among investors seeking stable returns. Treasury bond issued by the Central Bank of Kenya offer varying maturities and competitive yields, providing ideal compounding opportunities. With regular interest payments that can be reinvested, these bond help investors leverage compounding to grow wealth over time.

Kenya also has a vibrant corporate bond market, where companies issue bonds to raise capital for expansion. Corporate bond often provide higher yields than government bond, making them attractive for compounding, though they come with added risks that investors should consider carefully.

Bond ETFs in Kenya

Bond Exchange-Traded Funds (ETFs) are gaining traction as they offer diversified exposure to bonds. With low fees and automatic reinvestment options, bond ETFs make it convenient for investors to benefit from compounding in a diversified portfolio.

Also Read: How Compounding Builds Wealth in Real Estate

Compounding is a powerful tool that can turn bond into a reliable wealth-building asset. By reinvesting interest payments and strategically selecting bond that align with your goals, you can maximize the growth potential of your bond investments. Whether you’re investing in government bonds for stability or corporate bonds for higher returns, compounding in bond offers a path to steady and consistent financial growth.

For investors in Kenya, the bond market provides ample opportunities to benefit from compounding, especially through government bond and corporate offerings. By understanding economic cycles, choosing the right types of bond, and reinvesting interest, you can create a bond portfolio that compounds over time, helping you achieve your financial goals.