Step-by-Step Guide

Creating a personal budget plan is essential for achieving financial stability and reaching your financial goals. With the economic uncertainties and rising cost of living, having a well-structured budget is more important than ever. This comprehensive guide will take you through the steps to create a successful budget plan for 2024, ensuring you can manage your finances effectively and confidently.

Step 1: Set Clear Financial Goals

The first step in creating a budget is to establish your financial goals. These goals can be short-term (saving for a vacation), mid-term (buying a car), or long-term (retirement planning). Clearly defined goals will give you a direction and purpose for your budget.

Tips for Setting Financial Goals

- Be Specific: Define the exact amount you need and the timeline for achieving it.

- Make it Measurable: Ensure you can track your progress.

- Be Realistic: Set achievable goals based on your income and expenses.

- Prioritize: Focus on what’s most important to you.

Step 2: Track Your Income and Expenses

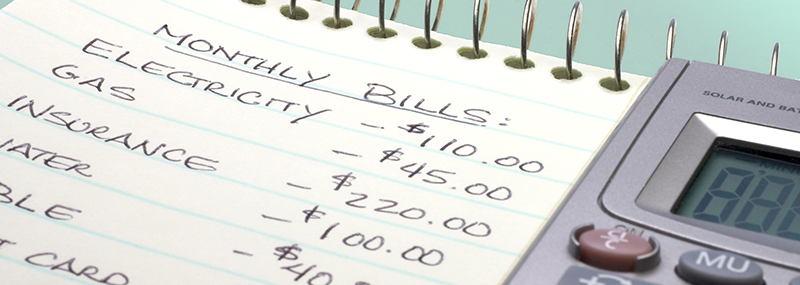

Understanding your cash flow is crucial. Start by listing all your sources of income and then track your expenses. This includes fixed expenses (rent, utilities) and variable expenses (groceries, entertainment).

Tools for budget Tracking

- Budgeting Apps: Mint, YNAB (You Need a Budget), PocketGuard.

- Spreadsheets: Google Sheets or Excel.

- Bank Statements: Review past statements to get an accurate picture of your spending habits.

Step 3: Categorize Your Expenses

Categorizing your expenses helps you see where your money is going and identify areas where you can cut back. Common categories include:

- Housing

- Utilities

- Food

- Transportation

- Healthcare

- Debt repayment

- Savings

- Entertainment

Step 4: Create a Savings/Investment Plan

Saving/Investment should be a non-negotiable part of your budget. Whether you’re building an emergency fund, investing or saving for a specific goal, allocate a portion of your income to savings/investment each month.

Tips for Effective Saving

- Automate Your Savings/Investment: Set up automatic transfers to your savings or investment(such as MMF) account.

- Start Small: Begin with a manageable amount and increase it over time.

- Emergency Fund: Aim to save 3-6 months’ worth of living expenses as the first goal.

Get Informed: A Comprehensive Guide to Invest in MMF

Step 5: Manage and Reduce Debt

Debt can hinder your financial progress, so it’s important to have a plan to manage and reduce it. Focus on high-interest debt first and consider strategies like debt consolidation or refinancing.

Debt Reduction Strategies

- Debt Snowball Method: Pay off the smallest debts first to build momentum.

- Debt Avalanche Method: Focus on paying off the highest interest debt first to save on interest payments.

Step 6: Use Budgeting Tools and Apps

Leverage technology to help you stick to your budget. Budgeting tools and apps can simplify the process of tracking your income and expenses, setting goals, and staying on top of your financial plan.

Popular Budgeting Tools

- Mint: Tracks expenses and creates budgets automatically.

- YNAB: Focuses on giving every dollar a job.

- PocketGuard: Shows how much you have left to spend after bills and savings.

Step 7: Adjust Your Budget for Inflation

Inflation can erode your purchasing power, so it’s crucial to adjust your budget accordingly. Review and revise your budget periodically to account for rising costs and ensure you stay on track.

Tips for Adjusting Your Budget

- Regular Reviews: Assess your budget monthly or quarterly.

- Cost of Living Increases: Factor in any increases in rent, groceries, or other essential expenses.

- Adjust Savings Goals: Increase your savings rate to match inflation.

Step 8: Monitor and Review Your Budget Regularly

A budget isn’t a set-it-and-forget-it tool. Regularly reviewing your budget helps you stay on track and make necessary adjustments. Set aside time each month to review your progress and make any necessary changes.

Monitoring Techniques

- Monthly Check-ins: Review your budget at the end of each month.

- Quarterly Reviews: Assess your financial goals and progress every three months.

- Annual Review: At the end of the year, evaluate your overall financial health and set new goals for the next year.

Creating a personal budget plan for 2024 is an ongoing process that requires careful planning, regular monitoring, and adjustments as your financial situation changes. By setting clear goals, tracking your income and expenses, and using the right tools, you can take control of your finances and achieve your financial goals. Remember, the key to a successful budget is consistency and flexibility. Stay committed to your financial plan, and you’ll see the benefits in no time.

Additional Resources For Your Budget

- Books: “Your Money or Your Life” by Vicki Robin, “The Total Money Makeover” by Dave Ramsey

- Websites: Investopedia, NerdWallet, The Balance

- Financial Advisors: Consider consulting with a certified financial planner for personalized advice.

Creating a personal budget plan for 2024 can set you on the path to financial success. By following these steps and staying committed to your goals, you’ll be well-equipped to handle any financial challenges that come your way.