The Myth of Saving Your Way to Wealth

Saving money is often hailed as the cornerstone of financial discipline, and rightly so. But saving alone is not a golden ticket to wealth. While it forms a critical foundation for financial security, wealth-building requires a multi-pronged approach involving investing, risk management, and maintaining an emergency fund. We explore why saving is insufficient for creating wealth, the role of investing, and the necessity of emergency funds. You’ll discover practical strategies to balance saving and investing while staying financially prepared for life’s uncertainties.

The Limitations of Relying Solely on Saving

Savings accounts are invaluable for short-term financial goals and emergency preparedness. However, they are ill-suited for long-term wealth creation. Here’s why:

1. Low Returns on Savings

- Most traditional savings accounts offer interest rates that barely keep up with inflation. For instance, if inflation averages 3% annually and your savings earn only 2%, the real value of your money decreases over time.

- High-yield savings accounts offer slightly better returns, but they still fall short of the growth potential found in investment vehicles like stocks or mutual funds.

2. Erosion of Purchasing Power

- Inflation reduces the purchasing power of money saved in low-interest accounts. A loaf of bread that costs $2 today might cost $3 in 10 years. If your savings don’t outpace inflation, you risk losing value.

3. Missed Opportunities for Wealth Growth

- Money parked in a savings account misses out on opportunities to grow through compound interest. Investing allows your money to generate returns, which then earn returns themselves—a concept known as compounding.

The Case for Investing: Building Wealth Actively

Investing is not just an option; it is a necessity for achieving financial independence. Unlike saving, investing provides an opportunity to grow wealth significantly over time.

1. The Power of Compounding

- Compounding allows your investments to grow exponentially. For example, investing $10,000 in an index fund that earns 8% annually can grow to over $100,000 in 30 years due to compounding returns.

2. Diversification of Income Streams

- Investments in stocks, real estate, or mutual funds diversify your income sources, reducing reliance on a single stream of revenue like a paycheck or savings account.

3. Hedge Against Inflation

- Investments, especially in equities or real estate, have historically outpaced inflation, ensuring your wealth grows in real terms.

4. Potential for Passive Income

- Investing in dividend-paying stocks, rental properties, or peer-to-peer lending platforms can generate a steady passive income stream, supplementing your active income.

Balancing Saving and Investing

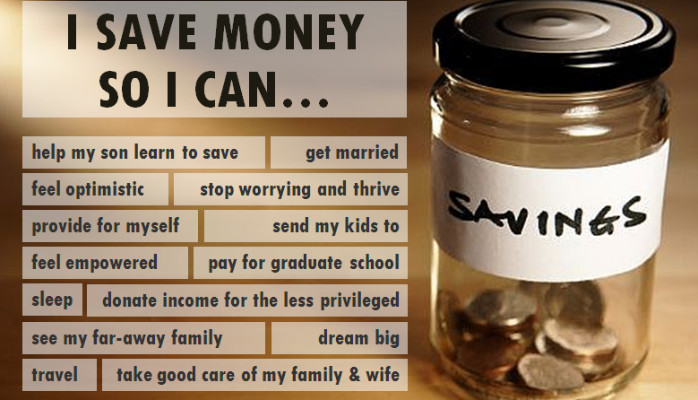

Achieving financial security requires a balance between saving for emergencies and investing for wealth creation.

Establish an Emergency Fund

- Purpose: An emergency fund provides a safety net for unexpected events like job loss, medical emergencies, or urgent repairs.

- Amount: Aim to save 3–6 months’ worth of living expenses. For individuals with unstable income, consider saving up to 12 months’ expenses.

- Account Type: Keep your emergency fund in a liquid, high-yield savings account for easy access and minimal penalties.

Invest Strategically

- Determine Risk Tolerance: Evaluate how much risk you are willing to take. Younger investors with a long time horizon can typically afford higher risks.

- Set Investment Goals: Identify short-term and long-term financial goals. For example, saving for retirement is a long-term goal, while buying a car might be short-term.

- Diversify Investments: Spread your investments across asset classes like stocks, bonds, real estate, and exchange-traded funds (ETFs) to reduce risk.

Automate Both Saving and Investing

- Use automation tools to consistently save and invest. Automated transfers to savings accounts and investment platforms ensure discipline and consistency.

How to Build an Emergency Fund

1. Start Small but Start Now

- Begin by saving a manageable amount each month. Even $50 a month can accumulate over time.

2. Cut Non-Essential Expenses

- Identify areas where you can cut back, such as dining out or subscription services, to redirect funds toward your emergency savings.

3. Use Windfalls Wisely

- Allocate bonuses, tax refunds, or unexpected financial windfalls to your emergency fund instead of spending them.

4. Replenish When Used

- If you dip into your emergency fund, prioritize replenishing it to maintain financial security.

Effective Investing Strategies for Wealth Building

1. Start Early

- The earlier you start investing, the longer your money has to grow. Even small contributions made early can yield significant returns over time.

2. Leverage Dollar-Cost Averaging

- Regularly invest a fixed amount, regardless of market conditions. This strategy helps mitigate the risk of market volatility.

3. Focus on Low-Cost Investments

- Minimize fees by choosing low-cost index funds or ETFs. High fees can eat into your returns over time.

4. Invest in What You Understand

- Stick to investment options you understand, whether it’s stocks, bonds, or real estate. Consider consulting a financial advisor if needed.

5. Rebalance Your Portfolio

- Periodically review and adjust your investments to align with your financial goals and risk tolerance.

Common Mistakes to Avoid

1. Over-Saving at the Expense of Investing

- While saving is essential, hoarding excessive cash without investing means missing out on higher returns.

2. Investing Without an Emergency Fund

- Without an emergency fund, you may be forced to liquidate investments during downturns, incurring losses.

3. Neglecting to Diversify

- Putting all your money into one investment type increases risk. Diversification protects against significant losses.

4. Reacting Emotionally to Market Fluctuations

- Avoid making impulsive investment decisions during market volatility. Stick to your long-term strategy.

Why Financial Education is Key

Understanding the fundamentals of saving, investing, and risk management empowers you to make informed financial decisions. Consider reading finance blogs, attending webinars, or consulting experts to expand your knowledge.

FAQs: Saving, Investing, and Building Wealth

Why can’t I save my way to riches?

Saving alone doesn’t generate substantial wealth because savings accounts typically offer low interest rates that fail to outpace inflation. To build wealth, you need to invest in assets like stocks, real estate, or bonds that have the potential for higher returns.

How much should I save before I start investing?

Aim to save at least 3–6 months’ worth of living expenses in an emergency fund. Once you have this safety net, you can begin investing surplus income for long-term growth.

What is the ideal balance between saving and investing?

The balance depends on your financial goals, age, and risk tolerance. As a rule of thumb, prioritize building an emergency fund first, then allocate a portion of your income to investments. A 50-30-20 budget rule can help: 50% for needs, 30% for wants, and 20% for saving and investing.

What is an emergency fund, and why is it important?

An emergency fund is a financial buffer set aside to cover unexpected expenses, such as medical emergencies, job loss, or urgent repairs. It protects you from going into debt or liquidating investments prematurely.

What are the best investment options for beginners?

Beginners can start with low-risk and low-cost options like index funds, ETFs, or robo-advisors. These investments offer diversification and require minimal management expertise.

How does inflation affect my savings?

Inflation reduces the purchasing power of your money. If your savings interest rate is lower than the inflation rate, the real value of your money decreases over time.

Is it better to save in a high-yield account or invest?

Both have their place in a financial plan. Use high-yield savings accounts for short-term goals and emergency funds. For long-term goals, investing provides better growth potential.

What is dollar-cost averaging in investing?

Dollar-cost averaging involves consistently investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy reduces the impact of market volatility and avoids timing the market.

How can I start investing with limited funds?

You can start small by investing in fractional shares, ETFs, or micro-investing apps. Many platforms allow you to invest with as little as $5.

Why is financial education important for wealth-building?

Financial education equips you with the knowledge to make informed decisions about saving, investing, and managing risks. It empowers you to develop strategies that align with your goals and navigate economic uncertainties.

Should I pay off debt before investing?

Focus on paying off high-interest debt, such as credit card balances, before investing. Once your debt is manageable, you can allocate funds toward both debt repayment and investing.

How can I avoid emotional investing decisions?

Set clear financial goals and stick to a long-term plan. Avoid reacting impulsively to market fluctuations, and seek advice from a financial advisor if needed.

What’s the difference between saving and investing?

Saving involves setting aside money in a secure and liquid account for short-term needs and emergencies. Investing involves putting money into assets like stocks, real estate, or bonds to grow wealth over time.

How do I know if I’m saving or investing enough?

Track your progress toward financial goals regularly. Use budgeting tools and investment calculators to ensure you’re allocating funds effectively for both saving and investing.

Can I build wealth without investing?

Building wealth without investing is extremely challenging due to inflation and the limited growth potential of savings. Investing provides the compounding growth necessary for significant wealth creation.

Also Read: Avoid Overpaying for Goods and Services in 2025

A Holistic Approach to Wealth

While saving is a vital financial habit, it is not the sole pathway to riches. Combining disciplined saving with strategic investing and maintaining a robust emergency fund creates a balanced approach to financial health. By taking proactive steps to understand and implement these strategies, you set yourself on a trajectory toward financial freedom and long-term wealth.