The Truth Behind Kenya’s Suspicious Bond Transactions

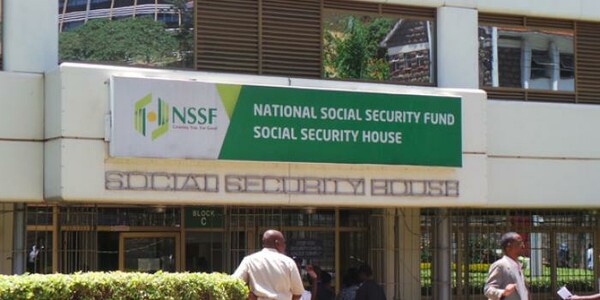

Kenya’s National Social Security Fund (NSSF), a pillar of workers’ financial security, is embroiled in controversy over alleged irregularities in bond transactions. The accusations, coupled with ongoing investigations, have exposed significant governance and accountability challenges in the country’s financial markets.

These allegations have not only shaken public trust in NSSF but also raised critical questions about the effectiveness of Kenya’s financial regulators, including the Central Bank of Kenya (CBK) and the Capital Markets Authority (CMA).

Background: What Sparked the Investigation?

The current crisis began when CBK flagged suspicious bond trading patterns involving NSSF accounts in May 2024. According to CBK, the fund engaged in questionable transactions where bonds were sold at below-market prices and repurchased at higher rates shortly thereafter.

These irregular activities came to light following a detailed review of NSSF’s Central Securities Depository (CSD) accounts, as well as those of key parties, including Pergamon Investment Bank Ltd and individual trader Humphrey Wachira Gichuru. The findings prompted CBK to alert CMA and recommend immediate investigations into potential financial malpractice.

CBK raised concerns over:

- Bonds being purchased above market prices.

- Repeated patterns of selling low and buying high, leading to potential losses for NSSF.

- Possible insider dealings benefiting third parties while disadvantaging the fund.

Regulators on the Spotlight

Once CBK flagged the suspicious transactions, it fell upon CMA to investigate. However, the process has faced significant delays, leading to frustrations from CBK and growing public scrutiny of the regulators’ effectiveness.

CBK Governor Kamau Thugge and CMA Chief Executive Wycliffe Shamiah were summoned by the National Assembly’s Finance and National Planning Committee to provide updates on the investigation. Despite the urgency, CMA has struggled to make meaningful progress, citing:

- The premature leaking of CBK’s letter, allowing suspects to destroy potential evidence.

- The involvement of influential individuals, complicating the investigation.

Public Outrage and the Erosion of Trust

The scandal has struck a nerve with Kenyan citizens, many of whom contribute to National Social Security Fund (NSSF) as part of their retirement savings. Allegations of financial mismanagement within the fund have prompted widespread outrage, with contributors questioning the safety of their hard-earned money.

This is not NSSF’s first brush with controversy. In July 2024, a former NSSF manager was convicted for embezzling Ksh. 1.2 billion. These repeated scandals highlight systemic governance failures within the organization and a lack of accountability for managing public funds.

The Role of Kenya’s Financial Regulators

This incident has also highlighted weaknesses in Kenya’s regulatory framework. While both CBK and CMA play vital roles in maintaining financial stability and market integrity, their lack of coordination has come under sharp criticism.

For instance, CBK’s frustration over the slow pace of CMA’s investigation raises questions about their ability to act decisively in cases of financial impropriety. Critics argue that regulatory reforms are needed to ensure faster responses and more robust oversight mechanisms.

Potential Legal Ramifications

If the allegations are proven true, those involved could face severe consequences, including criminal charges and asset seizures. The Public Finance Management Act and Capital Markets Act both provide stringent penalties for mismanagement of public funds and insider trading.

Furthermore, Parliament has vowed to hold all individuals and institutions accountable, signaling a growing intolerance for corruption within public institutions.

Lessons from the Scandal

The NSSF bond scandal offers several critical lessons for Kenya’s financial system:

- Stronger Internal Controls: National Social Security Fund (NSSF) must implement transparent investment procedures to prevent similar occurrences.

- Regulatory Reforms: CBK and CMA need to improve their coordination and develop faster response mechanisms for financial irregularities.

- Public Oversight: Increased public scrutiny and independent audits of public funds can serve as deterrents against financial mismanagement.

Restoring Public Confidence

To rebuild trust, NSSF must prioritize transparency and accountability. This includes:

- Regular public disclosures of financial performance and investment activities.

- Hiring independent auditors to review past transactions.

- Introducing stricter checks and balances to prevent future mismanagement.

Additionally, regulatory bodies like CBK and CMA must demonstrate their commitment to protecting public funds by concluding their investigations swiftly and holding culprits accountable.

Global Context: A Universal Challenge

Kenya’s challenges with NSSF mirror global trends where pension funds and public institutions often face allegations of mismanagement. Countries like South Africa and Brazil have grappled with similar issues, highlighting the universal need for robust governance frameworks in public finance management.

The Road Ahead

As Kenya waits for the outcome of investigations, this scandal serves as a critical turning point for public fund management. It is an opportunity for both National Social Security Fund (NSSF) and regulators to reform, rebuild trust, and set an example for other institutions.

In the long run, Kenya’s ability to attract domestic and international investors will depend on its commitment to transparency, accountability, and the rule of law.

FAQs

What is the NSSF bond scandal?

The scandal involves allegations of irregular bond transactions by NSSF, including buying bonds at inflated prices and selling them at losses.

What is being done to investigate the matter?

CBK flagged the transactions, and CMA is conducting investigations. Parliament has also summoned regulatory heads for updates.

How does this impact NSSF contributors?

If the allegations are proven, it means contributors’ funds were mismanaged, potentially leading to financial losses for the fund.

What reforms are necessary to prevent future scandals?

Stronger internal controls at NSSF, improved coordination between regulators, and greater transparency in public fund management are essential.

What are the potential penalties for those involved?

Individuals found guilty could face criminal charges, fines, and asset forfeitures under Kenyan law.

A Call for Action

The NSSF bond scandal underscores the urgent need for accountability and reform in Kenya’s financial systems. As investigations unfold, the hope is that justice will prevail, setting a precedent for transparency and integrity in managing public resources.

Only through decisive action can Kenya restore faith in its institutions and safeguard the future of its citizens’ hard-earned savings.