Kenya’s financial sector is witnessing a groundbreaking transformation with the integration of M-Pesa, the leading mobile money platform, and PesaLink, the interbank money transfer system. This move is set to redefine how individuals and businesses transact, enhancing interoperability, reducing transaction costs, and promoting financial inclusion. As digital payments continue to dominate Kenya’s economy, this partnership signals a new era of convenience and efficiency in financial services.

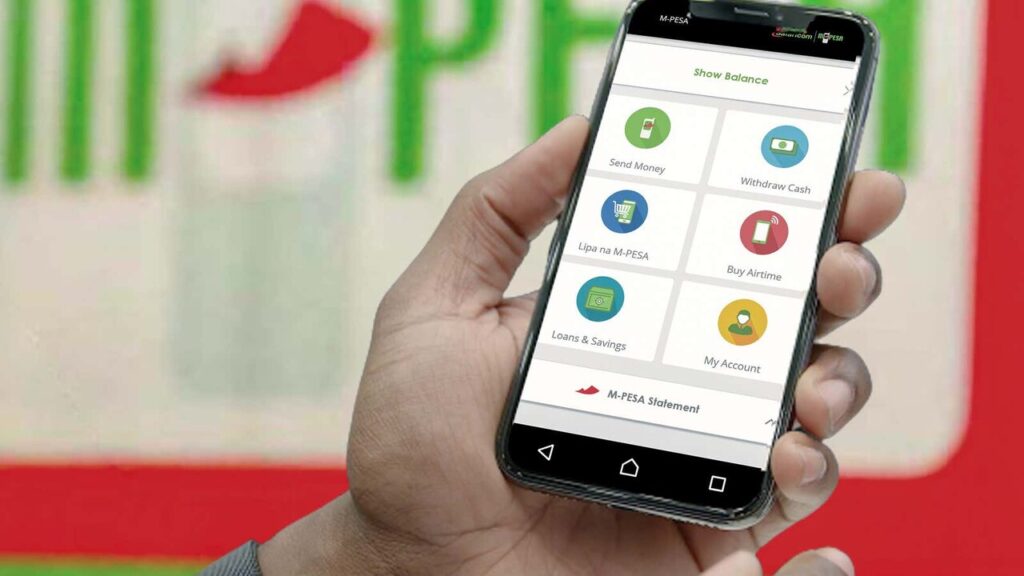

What is M-Pesa?

M-Pesa, launched in 2007 by Safaricom, is a revolutionary mobile money platform that has transformed Kenya’s financial landscape. Initially designed for peer-to-peer money transfers, M-Pesa has evolved into a multifaceted financial tool offering:

- Money transfers

- Bill payments

- Loan services

- Savings products

- International remittances

M-Pesa is widely recognized as one of the most successful mobile money platforms globally, boasting over 51 million active users across Africa as of 2024. In Kenya, it accounts for a significant portion of the country’s Gross Domestic Product (GDP), with transactions worth billions processed daily.

What is PesaLink?

PesaLink, introduced in 2017 by the Kenya Bankers Association (KBA), is a real-time interbank transfer platform. It enables bank account holders to transfer money instantly between accounts without needing intermediaries like traditional payment gateways. Key features of PesaLink include:

- Support for high-value transactions (up to KES 999,999 per transfer)

- 24/7 availability

- Lower transaction costs compared to traditional bank transfers

- Direct integration with Kenya’s banking system

PesaLink currently supports over 30 banks in Kenya, making it a critical component of the country’s banking infrastructure.

Why M-Pesa and PesaLink Integration is a Game-Changer

The integration of M-Pesa and PesaLink represents a monumental step toward achieving full interoperability in Kenya’s financial sector. This partnership addresses a long-standing challenge of connecting mobile money platforms and traditional banking systems, allowing users to transact seamlessly between the two.

Enhanced Interoperability

Previously, moving money from an M-Pesa wallet to a bank account (or vice versa) required multiple steps, often involving third-party platforms and higher costs. With this integration, users can:

- Transfer money instantly between M-Pesa and PesaLink accounts.

- Avoid the hassle of withdrawing cash or using intermediary apps.

- Access a unified ecosystem for financial transactions.

Cost Savings

M-Pesa transactions currently attract higher fees for transferring significant amounts. For example, sending KES 10,000 via M-Pesa costs approximately KES 100. In contrast, PesaLink charges significantly less for similar transfers. By integrating these platforms, users can enjoy reduced transaction costs, particularly for high-value transfers.

Improved User Experience

Both M-Pesa and PesaLink are known for their simplicity and reliability. Their integration will enhance the user experience by combining the intuitive interface of M-Pesa with PesaLink’s robust banking infrastructure. This ensures:

- Real-time processing of transactions.

- Simplified processes for individuals and businesses.

- Greater convenience for users who operate across both systems.

How the Integration Aligns with Kenya’s Financial Goals

The integration supports the Central Bank of Kenya’s (CBK) strategic goals of promoting financial inclusion and interoperability. It aligns with the government’s efforts to:

- Drive Cashless Payments: The CBK has been advocating for a shift toward cashless transactions to enhance transparency and efficiency. M-Pesa and PesaLink integration accelerates this goal by providing a reliable and affordable digital payment solution.

- Bridge the Financial Divide: Many Kenyans remain unbanked or underbanked, relying solely on mobile money platforms like M-Pesa. This partnership enables these individuals to access traditional banking services through PesaLink, fostering greater financial inclusion.

- Support Small and Medium Enterprises (SMEs): SMEs, which form the backbone of Kenya’s economy, can benefit immensely from this integration. It simplifies payment processes, reduces costs, and provides faster access to funds, empowering businesses to thrive in a competitive market.

Benefits of M-Pesa and PesaLink Integration

1. Convenience and Efficiency

The integration eliminates the need for third-party apps or complex procedures when transferring money between mobile wallets and bank accounts. Users can complete transactions in real time, enhancing convenience and efficiency.

2. Affordable Transactions

By leveraging PesaLink’s low-cost structure, Safaricom can offer more affordable rates for M-Pesa users. This is particularly beneficial for high-value transactions, which currently incur higher fees on mobile money platforms.

3. Financial Inclusion

The integration brings the unbanked population closer to formal financial systems. Users who rely on M-Pesa for their financial needs can now access banking services such as loans, savings, and investments through PesaLink.

4. Empowering SMEs

SMEs can leverage this integration to streamline their payment processes, enabling faster and more cost-effective transactions. This is crucial for businesses that rely on frequent transfers between mobile wallets and bank accounts.

5. Economic Growth

By facilitating seamless transactions and reducing costs, the integration contributes to Kenya’s overall economic growth. It encourages more digital transactions, reducing reliance on cash and enhancing economic efficiency.

Challenges of the Integration

Despite its numerous benefits, the M-Pesa and PesaLink integration faces several challenges:

1. Technical Complexity

Integrating two established platforms with distinct architectures requires significant technical expertise. Safaricom and the KBA must ensure that the integration is seamless, secure, and scalable to handle high transaction volumes.

2. Regulatory Oversight

The CBK will play a critical role in overseeing this integration. It must establish clear guidelines to ensure consumer protection, data security, and compliance with anti-money laundering (AML) regulations.

3. User Education

Many users may be unfamiliar with PesaLink or how the integration works. Safaricom and the KBA will need to invest in awareness campaigns to educate users about the benefits and functionality of the integrated system.

4. Security Risks

As with any financial system, the integration must prioritize security to prevent fraud and cyber threats. Both platforms will need to implement robust security measures to safeguard user data and transactions.

What This Means for Consumers

Individuals

For individual users, the integration simplifies everyday transactions. Whether it’s sending money to a family member, paying bills, or withdrawing funds from a bank account, the process becomes faster, cheaper, and more accessible.

Businesses

Businesses, particularly SMEs, stand to gain significantly from this integration. They can manage payments more efficiently, reduce transaction costs, and access a broader customer base that operates across both platforms.

Banks

Banks benefit from increased transaction volumes and enhanced customer engagement. By connecting with M-Pesa’s vast user base, banks can attract more customers and offer innovative financial products.

Also Read: Safaricom’s Ziidi Money Market Fund Attracts Kshs. 2.85 Bn in First Month

The Future of Kenya’s Financial Ecosystem

The M-Pesa and PesaLink integration marks a pivotal moment in Kenya’s journey toward a fully digital economy. As the financial landscape evolves, we can expect:

- Greater collaboration between mobile money platforms and banks.

- Increased adoption of cashless payments across all sectors.

- Innovative financial products that cater to diverse customer needs.

This integration sets a precedent for other countries in Africa and beyond, showcasing the potential of interoperability in driving financial inclusion and economic growth.

The integration of M-Pesa and PesaLink is a transformative step for Kenya’s financial sector. By combining the strengths of mobile money and traditional banking, this partnership offers unparalleled convenience, affordability, and inclusion for users. While challenges remain, the potential benefits far outweigh the hurdles, promising a brighter and more connected future for Kenya’s financial ecosystem.

As Kenya continues to lead in digital financial innovation, the M-Pesa and PesaLink integration is a testament to the country’s commitment to enhancing financial services and driving economic growth.