Why You Need Assets for Financial Independence

In the journey to financial independence, creating assets is a cornerstone strategy. Assets provide more than just short-term gains; they create sustainable wealth and can offer stability during market fluctuations. Whether you’re a budding investor or someone looking to diversify income streams, understanding how to build income-generating assets is crucial. This guide provides step-by-step insights into creating valuable assets that align with your financial goals.

1. What Are Income-Generating Assets?

Income-generating assets are investments or holdings that produce consistent revenue over time. Unlike liabilities, which drain resources, these assets grow your wealth and contribute to financial security. Common types include:

- Real Estate: Rental properties and REITs.

- Stocks: Dividend-paying equities.

- Digital Products: Courses, eBooks, and templates.

- Small Businesses: Brick-and-mortar shops or online stores.

- Royalties: Earnings from intellectual property like books, music, or patents.

2. Why Are Assets Crucial for Long-Term Financial Stability?

Income-generating assets are essential for:

- Building Passive Income: Reducing reliance on active labor.

- Securing Retirement: Providing consistent income streams during non-working years.

- Wealth Diversification: Reducing risk by spreading investments.

- Inflation Hedging: Protecting purchasing power.

By reinvesting returns, you can benefit from the power of compounding, where earnings generate more earnings, exponentially increasing wealth over time.

3. The Types of Income-Generating Assets

3.1 Real Estate Investments

Real estate offers one of the most reliable paths to wealth creation:

- Residential Rentals: Leasing out apartments or homes.

- Commercial Properties: Office spaces or retail shops for businesses.

- Real Estate Crowdfunding: Platforms like Fundraise enable small-scale investments.

- REITs (Real Estate Investment Trusts): Ideal for those who want exposure without managing properties directly.

3.2 Stock Market Investments

Equities allow you to own a stake in businesses while earning income:

- Dividend Stocks: Regular payouts from profitable companies.

- Index Funds: Diversified funds tracking market performance.

- Preferred Shares: Hybrid securities offering consistent dividends.

3.3 Fixed-Income Investments

Bonds and fixed-income securities provide stable, predictable returns:

- Corporate Bonds: Higher yields but greater risk than government bonds.

- Municipal Bonds: Tax-advantaged income streams.

- Green Bonds: Investments in eco-friendly projects with financial and environmental returns.

3.4 Digital Assets

In the digital age, intellectual property generates passive income:

- Online Courses: Use platforms like Udemy or Skillshare.

- eBooks: Self-publish on Amazon Kindle.

- Subscription Models: Offer gated content through Patreon or Substack.

3.5 Royalties and Licensing

Royalties offer ongoing income:

- Creative Works: Books, music, and art generate royalties per sale or stream.

- Product Licensing: License patents or inventions to businesses.

3.6 Money Market Funds (MMFs)

Money Market Funds offer low-risk, liquid investments with steady returns:

- Liquidity: Easy access to funds for short-term needs.

- Low Risk: Invests in stable securities like Treasury bills and commercial paper.

- Competitive Yields: Higher returns compared to traditional savings accounts, typically 8-12% annually in Kenya.

- Diverse Portfolio Options: Helps diversify investments with minimal risk to capital.

MMFs are ideal for preserving capital, earning modest returns, and maintaining financial flexibility.

4. Building Assets from Scratch: Step-by-Step Guide

4.1 Assess Your Financial Position

Before creating assets, evaluate:

- Budget: Determine available funds for investment.

- Risk Tolerance: Align investments with comfort levels.

- Financial Goals: Short-term vs. long-term aspirations.

4.2 Start Small

For beginners, focus on low-cost investments:

- Fractional Shares: Buy partial shares of high-value stocks through apps like Robinhood.

- Digital Products: Create low-cost eBooks or templates.

- Side Hustles: Use platforms like Etsy to sell handmade items.

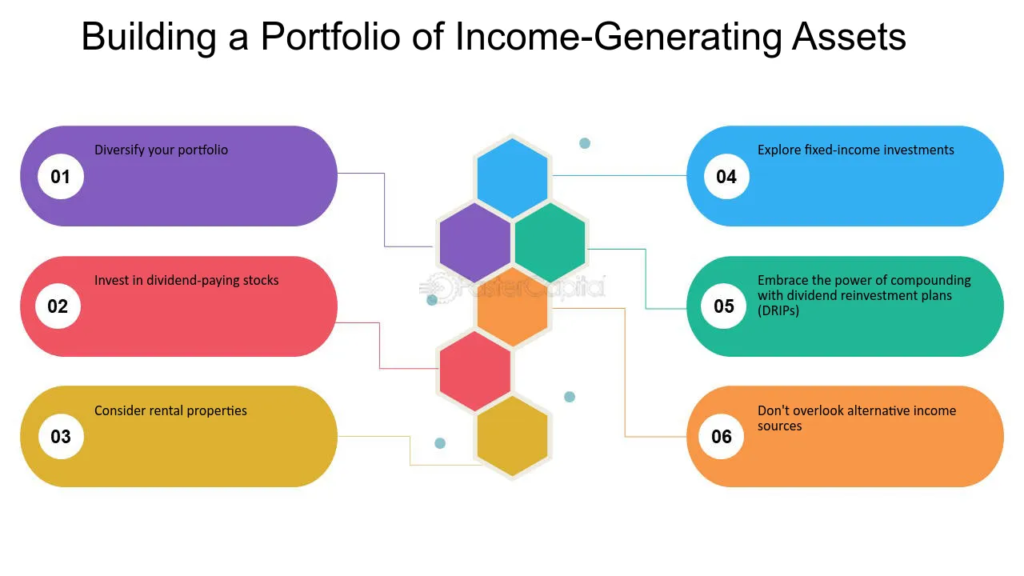

4.3 Diversify

Avoid over-reliance on a single asset type. For example:

- Combine real estate with digital and financial assets.

- Invest across industries for balanced growth.

4.4 Leverage Technology

Maximize efficiency by using tools and platforms:

- AI Tools: Generate content for digital products.

- Automation Software: Streamline operations for online businesses.

- Financial Apps: Track investments and growth.

5. Common Challenges in Asset Creation (and How to Overcome Them)

5.1 Lack of Capital

Solution: Start with low-cost assets like index funds or digital products.

5.2 Insufficient Knowledge

Solution: Take free courses on platforms like Coursera or Khan Academy.

5.3 Fear of Risk

Solution: Begin with low-risk options, such as bonds or REITs.

6. Advanced Strategies for Asset Growth

6.1 The Power of Compounding

Reinvest dividends and returns for exponential growth. For instance:

- Use rental income to acquire additional properties.

- Reinvest stock dividends to buy more shares.

6.2 Tax-Advantaged Investments

Maximize after-tax returns:

- Invest in tax-deferred accounts like IRAs.

- Opt for tax-free municipal bonds.

6.3 Partnering for Success

Collaborate with others to pool resources for large-scale projects like real estate developments.

7. Building Generational Wealth with Income-Generating Assets

7.1 Long-Term Planning

Invest in appreciating assets like:

- Blue-Chip Stocks: Stable companies with long-term growth.

- Real Estate: Properties in high-growth areas.

7.2 Estate Planning

Create trusts or wills to ensure assets pass seamlessly to heirs.

7.3 Sustainable Investments

Focus on eco-friendly options like green bonds or sustainable businesses.

8. The Future of Income-Generating Assets Creation in 2024

8.1 Digital Transformation

Expect continued growth in:

- NFTs (Non-Fungible Tokens) for digital ownership.

- Blockchain-based real estate transactions.

8.2 Global Opportunities

Expand beyond local markets through international real estate or stocks.

Start Building Assets Today

Creating income-generating assets is a journey requiring careful planning and consistent effort. By diversifying investments, leveraging the power of compounding, and staying informed about market trends, you can achieve financial security and independence. Whether you’re starting with small digital products or large-scale real estate, every step brings you closer to long-term wealth.

Also Read: Mutual Funds Made Easy: Your Path to Smart Investing

FAQs About Creating Income-Generating Assets

What is an income-generating asset?

An income-generating asset is any investment or resource that produces regular income, such as rental properties, dividend stocks, or intellectual property like eBooks.

How can I start creating assets with little or no money?

Start small by leveraging free or low-cost resources. Create digital products, invest in fractional shares, or join crowdfunding platforms for real estate or businesses.

What are the safest types of assets for beginners?

Low-risk options include government bonds, index funds, and REITs (Real Estate Investment Trusts). These provide steady returns with minimal risk.

How long does it take for an asset to generate income?

The timeline varies. Real estate rentals and dividend stocks may generate income within months, while digital products might take longer to gain traction.

How can I diversify my assets?

Invest in different asset classes, such as real estate, stocks, bonds, and digital products. This reduces risk and increases the potential for steady returns.

What is the power of compounding in asset creation?

Compounding occurs when earnings are reinvested to generate additional returns. For example, reinvested dividends can exponentially grow your stock portfolio.

Are there tax advantages to creating assets?

Yes, certain assets, like municipal bonds and tax-deferred accounts (IRAs), offer tax advantages, reducing your overall taxable income.

How do I know if an asset is worth investing in?

Evaluate its potential ROI (Return on Investment), risk level, and alignment with your financial goals. Research and consult with financial advisors if needed.

Can digital assets replace traditional investments?

Digital assets can complement traditional investments but may not fully replace them. Diversification across digital and physical assets ensures better financial stability.

What are some passive income ideas for 2024?

Popular options include renting out properties, investing in dividend stocks, creating online courses, or earning royalties from creative works.

Are MMFs safe for beginners?

Yes, MMFs are low-risk investments ideal for those new to financial markets.

How much can I earn with MMFs?

Earnings depend on interest rates and market conditions. In Kenya, MMFs typically yield 8-12% annually.

Can I lose money in an MMF?

While rare, losses are possible during extreme market instability. However, regulatory safeguards often minimize such risks.

How do I access funds in an MMF?

Most MMFs offer flexible withdrawal options, allowing you to access your funds within 1-3 business days.

Is there a minimum investment amount for MMFs?

Yes, the amount varies by provider. Many Kenyan MMFs have minimum requirements as low as Ksh 3,000.