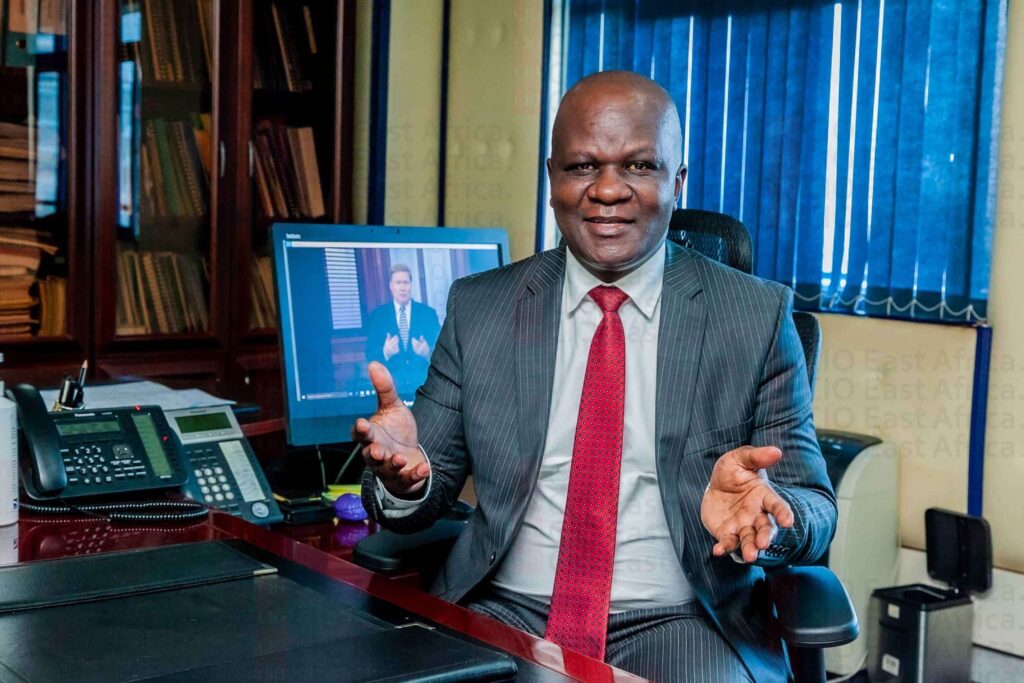

The Sh13 billion Kuscco fraud scandal has become one of the largest financial controversies in Kenya’s cooperative sector. It has raised serious questions about accountability, transparency, and the governance of cooperative organizations. At the center of the storm is George Otieno Ototo, Kuscco’s former Kuscco CEO, who has ignited public outrage by demanding Sh120 million in retirement perks.

As the financial backbone of Kenya’s cooperative sector, Kuscco supports over 4,000 Savings and Credit Co-operatives (Saccos). However, this scandal has eroded trust, jeopardizing the financial stability of members and cooperative projects.

The Kuscco Fraud: What Went Wrong?

Audit Exposes Deep-Rooted Mismanagement

A forensic audit conducted by PricewaterhouseCoopers (PwC) exposed the magnitude of the mismanagement. Over the years, top executives engaged in fraudulent activities that bled Kuscco of billions. For instance, unauthorized withdrawals and dubious loans became the norm under the organization’s leadership.

The report revealed alarming irregularities, such as:

- Unapproved Withdrawals:

Executives withdrew over Sh5.47 billion without proper authorization. On average, this equaled Sh41 million each month. - Questionable Transfers:

- Sh318 million was transferred to Kuscco Housing’s company secretary.

- Sh434 million ended up with insurance agencies under unclear circumstances.

- Illegitimate Loans:

Executives accessed loans totaling Sh61.5 million without board approval. George Otieno Ototo alone reportedly secured a Sh50 million loan. - Manipulated Financial Records:

Financial statements carried the signatures of deceased auditors, raising questions about how long the fraud went undetected.

These fraudulent practices have dealt a significant blow to Kuscco’s reputation, placing the cooperative sector under intense scrutiny.

The Role of George Otieno Ototo

A Leadership Legacy in Question

George Otieno Ototo served as Kuscco CEO for more than a decade. While his tenure saw significant growth in Kuscco’s operations, his leadership style is now under the microscope. The audit findings suggest that financial mismanagement thrived under his watch, tarnishing his legacy.

Although Ototo has not admitted guilt, his demand for Sh120 million in retirement perks has been seen as insensitive, particularly amid the ongoing scandal. Critics argue that such a demand reflects a lack of accountability and disregard for Kuscco’s financial crisis.

Ethical Implications of the Retirement Perks

The public backlash against Ototo’s retirement package stems from its timing and scale. Members of the cooperative view his request as unethical, given that thousands of depositors now face uncertainty about their savings.

Many observers believe that the former Kuscco CEO actions set a dangerous precedent. If leaders implicated in financial mismanagement are rewarded with large payouts, what message does this send about accountability in Kenya’s financial sector?

Impact on Kuscco Members

Loss of Trust and Confidence

The fraud has significantly eroded public trust in Kuscco. As the country’s leading cooperative body, Kuscco oversees deposits worth over Sh18.9 billion. The scandal has left many members questioning whether their savings are secure.

Several members have already expressed their intention to withdraw their funds. This could trigger a liquidity crisis, further jeopardizing Kuscco’s ability to support Saccos and their projects.

Vulnerability of Small Investors

Kuscco primarily serves small-scale entrepreneurs and cooperative groups. These members depend on the organization for financial support and stability. The loss of funds, however, has made them vulnerable, leaving some cooperative projects on the verge of collapse.

Wider Implications for the Sacco Movement

The fraud has raised concerns about the governance of other Saccos. If Kuscco, as the sector’s regulatory body, is vulnerable to corruption, what does this mean for smaller, less-regulated cooperatives?

Government Response: Holding Leaders Accountable

Disbanding the Kuscco Board

In the wake of the scandal, Cabinet Secretary Simon Chelugui dissolved Kuscco’s board and dismissed key executives implicated in the fraud. He emphasized the government’s commitment to restoring trust and ensuring accountability.

Investigations and Prosecutions

The Directorate of Criminal Investigations (DCI) is currently gathering evidence to prosecute those involved. Authorities have also frozen the assets of several individuals to recover stolen funds.

Proposed Reforms

The Ministry of Cooperatives has proposed several measures to strengthen governance and prevent future scandals. These include:

- Regular audits of cooperative organizations.

- Enhanced penalties for executives involved in financial mismanagement.

- Mandatory training programs for cooperative leaders.

By taking decisive action, the government aims to rebuild confidence in the cooperative sector while protecting investors from similar scandals in the future.

Lessons for Kenya’s Cooperative Sector

Importance of Transparency

The Kuscco fraud has highlighted the dangers of inadequate financial oversight. For Kenya’s cooperative sector to thrive, organizations must adopt transparent financial practices, such as real-time reporting and independent audits.

Strengthening Governance Structures

Stronger governance frameworks are critical in preventing financial mismanagement. This includes:

- Clearly defining roles and responsibilities for board members.

- Introducing checks and balances to limit the power of executives.

- Increasing member participation in decision-making processes.

Leveraging Technology

Digital solutions, such as blockchain, could enhance accountability in cooperative organizations. Blockchain technology, for example, provides an immutable record of transactions, making it easier to detect and prevent fraud.

Rebuilding Confidence in the Cooperative Sector

Restoring Member Trust

For Kuscco to regain trust, it must demonstrate transparency and accountability. This includes openly addressing the scandal, recovering stolen funds, and ensuring that implicated leaders face justice.

Protecting Member Investments

The cooperative sector must prioritize safeguarding member investments. This could involve creating stronger deposit insurance schemes and ensuring stricter financial controls.

Encouraging Ethical Leadership

The Kuscco scandal underscores the importance of ethical leadership in driving organizational success. Cooperative leaders must commit to upholding high standards of integrity, transparency, and accountability.

A Call to Action

The Sh13 billion Kuscco fraud serves as a stark reminder of the risks posed by weak financial oversight. As the former Kuscco CEO, George Otieno Ototo’s request for Sh120 million in retirement perks has added fuel to the fire, highlighting the need for ethical governance in Kenya’s cooperative sector.

Moving forward, all stakeholders must work together to strengthen governance, rebuild trust, and safeguard the future of cooperative organizations. By embracing transparency and accountability, Kenya’s cooperative sector can overcome its current challenges and continue to play a vital role in the country’s economic development.