When a person dies without leaving behind a valid will, their estate is distributed based on a set of legal rules called intestacy laws. These laws aim to determine who should inherit the deceased person’s assets. While the intention is to create fairness, intestacy laws can lead to outcomes that may not reflect the deceased’s wishes. Understanding intestacy laws is crucial for anyone looking to protect their family’s future and ensure that their legacy is distributed as intended.

This comprehensive guide explores intestacy laws, their implications, and how you can avoid dying intestate by creating a valid will.

What Does Intestate Mean?

“Intestate” refers to the condition of dying without a valid will. Without clear instructions from the deceased, intestacy laws step in to guide the process of distributing the estate.

Key terms related to intestacy:

- Decedent: The person who has passed away.

- Heirs: Individuals legally entitled to inherit under intestacy laws.

- Administrator: A court-appointed person responsible for managing the estate.

- Estate: All the assets, liabilities, and personal belongings of the decedent.

How Do Intestacy Laws Work?

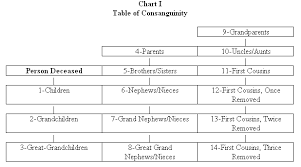

Intestacy laws follow a hierarchical structure to identify who inherits the deceased’s property. While these laws differ between jurisdictions, the general order of inheritance is relatively consistent:

- Surviving Spouse:

In most cases, the surviving spouse is prioritized in inheritance.- If the decedent has no children, the spouse may inherit the entire estate.

- If there are children, the estate may be divided between the spouse and the children, depending on the laws of the jurisdiction.

- Descendants:

After the spouse, children (and their descendants) are next in line to inherit. If a child has predeceased the decedent, their share may pass to their own children. - Parents:

If there is no surviving spouse or descendants, the estate often passes to the decedent’s parents. - Siblings:

In the absence of a spouse, descendants, or parents, siblings and their children are next in line. - Distant Relatives:

If none of the above relatives are alive, more distant relatives such as grandparents, aunts, uncles, or cousins may inherit. - Escheat:

If no heirs can be identified, the estate may “escheat,” meaning it is transferred to the state.

Key Factors Affecting Intestacy Laws

Marital Status

The rights of a surviving spouse often depend on whether the couple was legally married. In some jurisdictions, common-law spouses may also have inheritance rights, but this varies widely.

Children from Previous Relationships

If the deceased had children from multiple relationships, intestacy laws may divide the estate differently. For instance, stepchildren typically do not inherit unless formally adopted.

Adopted and Biological Children

Adopted children have the same inheritance rights as biological children. However, biological children born out of wedlock may need to establish paternity to inherit.

Half-Siblings

In most jurisdictions, half-siblings are treated equally to full siblings for inheritance purposes.

Intestacy Laws Around the World

Intestacy laws differ significantly by country and jurisdiction. Here are some examples:

- United States:

- Intestacy laws are state-specific. For example, in California, a surviving spouse may inherit all community property and a portion of separate property.

- United Kingdom:

- Under UK laws, a surviving spouse inherits the first £270,000 and half of the remaining estate if there are children.

- Kenya:

- Kenyan laws, guided by the Law of Succession Act, prioritize the surviving spouse, children, and other relatives in a set order.

- South Africa:

- South Africa follows the Intestate Succession Act, which divides the estate among the spouse and descendants.

The Role of Probate in Intestacy

Probate is the legal process of validating a will and distributing an estate. In cases of intestacy, probate courts:

- Appoint an administrator.

- Identify heirs according to intestacy laws.

- Ensure debts and taxes are paid before distributing the remaining assets.

Challenges of Intestacy

Unintended Heirs

Without a will, assets may go to relatives the deceased did not intend to inherit.

Family Disputes

Intestacy can lead to disagreements among family members, especially when multiple heirs are involved.

Delayed Asset Distribution

Probate can be a lengthy process, delaying the distribution of assets to heirs.

Higher Costs

The absence of a will may result in higher legal fees and administrative costs.

How to Avoid Intestacy

The best way to prevent intestacy is to create a valid will or comprehensive estate plan.

Steps to Create a Will

- Inventory Your Assets: List all property, investments, and belongings.

- Choose Beneficiaries: Decide who should inherit your assets.

- Appoint an Executor: Name someone you trust to manage your estate.

- Seek Legal Advice: Consult an attorney to ensure your will complies with local laws.

- Update Your Will: Regularly review and update your will to reflect life changes.

Other Estate Planning Tools

- Trusts: A legal arrangement where a trustee manages assets for beneficiaries.

- Joint Ownership: Property held jointly with rights of survivorship may pass directly to the co-owner.

Frequently Asked Questions About Intestacy Laws

- What happens if someone dies without a will?

Intestacy laws determine how the estate is distributed among relatives based on legal rules. - Can stepchildren inherit under intestacy laws?

Generally, stepchildren do not inherit unless legally adopted. - Do intestacy laws apply to all assets?

No. Assets like life insurance and retirement accounts with named beneficiaries bypass intestacy laws. - What is the role of an administrator in intestacy?

The administrator manages the estate, pays debts, and distributes assets according to these laws.

Intestacy laws serve as a safety net when someone dies without a will, ensuring that their estate is distributed to surviving relatives. However, these laws may not reflect the deceased’s personal wishes, making it crucial to create a valid will or estate plan. Understanding these laws and their implications can help you make informed decisions about protecting your assets and loved ones.