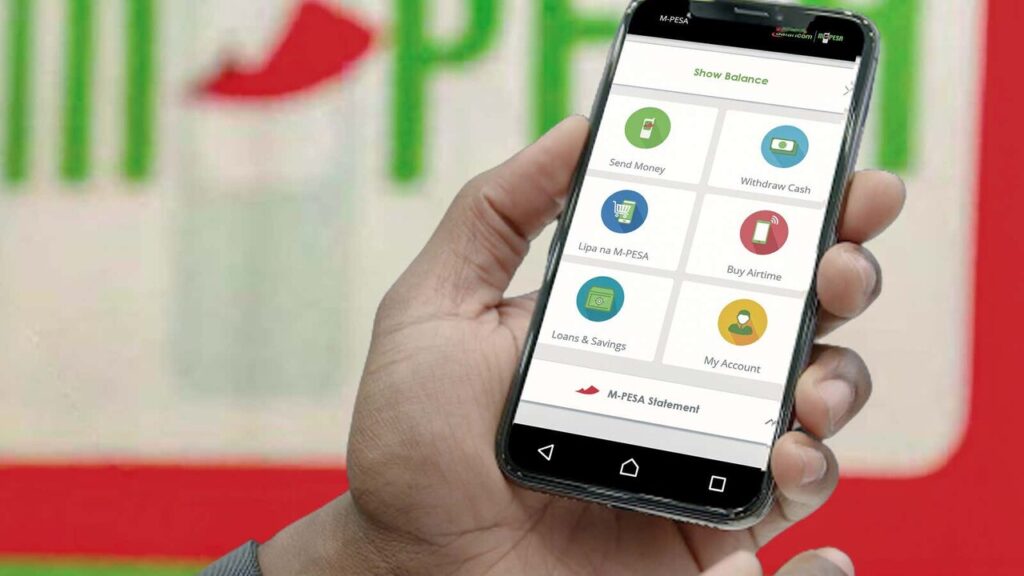

M-Pesa, Kenya’s leading mobile money platform by Safaricom, has revolutionized financial transactions. In early 2025, new M-Pesa withdrawal tariffs were introduced, raising questions about their implications for individual users and businesses. This article analyzes the updated fee structure and provides actionable strategies to manage costs effectively.

Overview of the New M-Pesa Withdrawal Tariffs

Safaricom adjusted its M-Pesa withdrawal fees to align with evolving operational costs and market dynamics. Here’s a breakdown of the revised tariffs:

Transaction Amount (KSh) | New Fee (KSh) |

|---|---|

50-100 | 11 |

101-500 | 29 |

7,501-10,000 | 115 |

10,001-15,000 | 167 |

35,001-50,000 | 278 |

50,001-150,000 | 309 |

Key Impacts of the New Tariffs

- Higher Costs for Withdrawals

The increase in fees directly affects users’ budgets, especially those who rely on frequent cash withdrawals for personal or business transactions. For instance, withdrawing between KSh 10,001 and KSh 15,000 will now cost KSh 167, up from KSh 162. - Shift Towards Cashless Transactions

With rising withdrawal fees, users may prefer using cashless alternatives like Lipa Na M-Pesa or bank transfers. This aligns with global trends in digital financial inclusion. - Low-Income Users Most Affected

Users transacting smaller amounts, such as KSh 500 or less, face proportional fee increases. For them, even an additional KSh 2 can significantly impact their daily financial operations. - Impact on Business Transactions

Businesses relying on M-Pesa for cash flow management must factor these new tariffs into their operational costs. Increased withdrawal fees may necessitate higher prices for goods and services.

How Users Can Adapt to the New Tariffs

1. Leverage Cashless Payments

Opt for M-Pesa services like Lipa Na M-Pesa for payments. These digital methods are not only convenient but also help avoid withdrawal charges.

2. Consolidate Withdrawals

Instead of making multiple small withdrawals, consider a single large transaction to reduce cumulative costs.

3. Explore Banking Integrations

Linking M-Pesa accounts to bank accounts can offer users more flexibility in managing their finances and avoiding withdrawal fees.

4. Maximize Agent Locations

M-Pesa agents may offer competitive rates for other services. Ensure you transact with official agents to avoid hidden charges.

5. Stay Updated on Fee Structures

Regularly visit the Safaricom website or M-Pesa app for updates on fees and new services.

Wider Implications on the Kenyan Economy

1. Increased Digital Financial Inclusion

As users embrace cashless payment options, Kenya’s drive towards a digital economy accelerates. M-Pesa remains central to this evolution.

2. Impacts on Financial Literacy

Fee increases highlight the importance of financial literacy, helping users optimize their transactions while avoiding unnecessary costs.

3. The Role of Fintech in Driving Change

Safaricom’s adjustment reflects broader trends in fintech innovation, ensuring profitability while maintaining accessibility for users.

FAQs About the New M-Pesa Withdrawal Tariffs

Why has Safaricom increased M-Pesa withdrawal fees?

The adjustments aim to balance rising operational costs while maintaining high-quality services for users.

Who is most affected by the new tariffs?

Low-income users and businesses relying on frequent cash withdrawals are the most impacted groups.

Are there alternatives to cash withdrawals?

Yes, Safaricom offers cashless solutions like Lipa Na M-Pesa, which enable users to pay directly without withdrawing funds.

How can I reduce my M-Pesa fees?

Plan your withdrawals strategically, consolidate transactions, and utilize cashless payment methods to minimize fees.

Will Safaricom introduce more changes in the future?

While no specific changes have been announced, users are encouraged to monitor official updates for any adjustments.

Safaricom’s new M-Pesa withdrawal tariffs underscore the evolving nature of mobile money services in Kenya. While the fee increases present challenges, they also encourage a shift towards digital financial practices. By staying informed and adopting strategic transaction habits, users can navigate these changes effectively.