Safaricom’s Game-Changer in Digital Wealth Growth

In December 2024, Safaricom, Kenya’s leading telecommunications company, introduced the Ziidi Money Market Fund (MMF), a groundbreaking investment platform designed to democratize access to financial growth for all Kenyans. This innovative service, seamlessly integrated with the widely used M-PESA platform, allows users to invest as little as KES 100 and earn competitive daily interest rates.

Understanding Money Market Funds

A Money Market Fund is a type of mutual fund that invests in short-term, low-risk financial instruments such as government securities, treasury bills, and commercial paper. These funds aim to provide investors with high liquidity and a stable income, making them an attractive option for individuals seeking low-risk investment opportunities.

Introducing Ziidi Money Market Fund (MMF)

Safaricom’s Ziidi MMF is a Collective Investment Scheme (CIS) regulated by the Capital Markets Authority (CMA) of Kenya. Developed in collaboration with Standard Investment Bank, ALA Capital Limited, and Sanlam Investments East Africa Limited, Ziidi offers a user-friendly and secure platform for Kenyans to grow their wealth.

Key Features of Ziidi Money Market Fund (MMF)

- Accessibility: With a minimum investment of just KES 100, Ziidi lowers the entry barrier, enabling a broader segment of the population to participate in wealth creation.

- Integration with M-PESA: Leveraging the extensive reach of M-PESA, users can effortlessly deposit and withdraw funds, ensuring real-time access to their investments.

- Competitive Interest Rates: Ziidi offers attractive daily interest rates, providing a viable alternative to traditional savings accounts that often yield minimal returns.

- Zero Transaction Costs: Investors enjoy zero-rated transactions, meaning no fees are charged for deposits or withdrawals, and there are no maintenance fees.

- Security: Protected by the user’s M-PESA PIN, Ziidi ensures that investments are secure, with each transaction requiring PIN verification.

How to Get Started with Ziidi Money Market Fund (MMF)

You can access Ziidi MMF in two ways, namely: M-PESA App and USSD

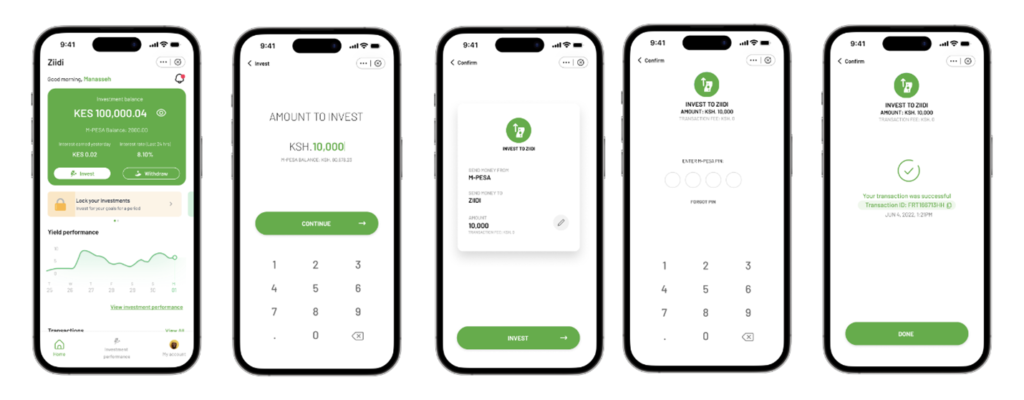

How to access Ziidi on the M-PESA App

- Download M-PESA App from your app store

- Log into the App

- Go to the Grow tab on your M-PESA App

- Tap on the ZIIDI icon to begin your investment journey

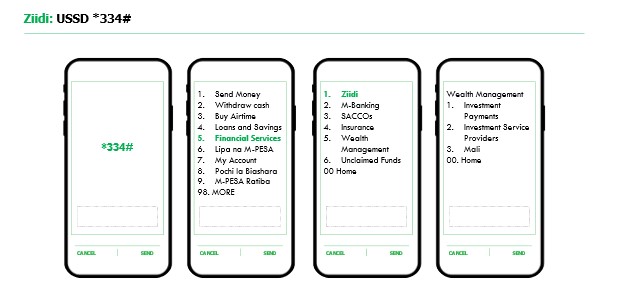

USSD *334#

- Dial *334# on your phone

- Select Financial Services – Option 5

- Select ZIIDI to begin your investment journey – Option 1

The Significance of Ziidi in Kenya’s Financial Landscape

Kenya has long been recognized as a global leader in mobile money adoption, with M-PESA playing a pivotal role in driving financial inclusion. The introduction of Ziidi MMF further cements this position by providing an investment platform that is both accessible and user-friendly.

Financial Inclusion

By lowering the minimum investment amount to KES 100, Ziidi Money Market Fund (MMF) opens up investment opportunities to individuals who previously may have found traditional investment avenues inaccessible. This inclusivity ensures that more Kenyans can participate in wealth creation and financial growth.

Digital Finance Integration

The seamless integration of Ziidi with M-PESA exemplifies the potential of digital finance solutions in enhancing user experience. Users can manage their investments alongside other financial transactions within a single platform, promoting efficiency and convenience.

Competitive Landscape

The Kenyan financial market is home to several Money Market Funds, each vying for investors’ attention. Ziidi’s success will largely depend on its ability to differentiate itself through higher returns, lower fees, and an enhanced user experience.

Comparing Ziidi with Other Money Market Funds in Kenya

The Kenyan financial market features several MMFs, each with varying minimum investment requirements, interest rates, and accessibility features. Here’s how Ziidi compares:

Fund Name | Min Investment | Interest Rate | Accessibility | Withdrawal Time |

|---|---|---|---|---|

Ziidi (Safaricom) | KES 100 | 13.65% | M-PESA | Instant |

Cytonn MMF | KES 1,000 | ~14% | Online | 2-3 business days |

CIC MMF | KES 5,000 | ~10% | Online | 1-2 business days |

Britam Unit Trust | KES 5,000 | ~11% | Online | 1-2 business days |

Etica MMF | KES 1,000 | ~13% | Online | 1-2 business days |

Lofty Coban MMF | KES 500 | ~14% | App-Based | Instant |

Ziidi stands out with its low minimum investment, competitive interest rate, seamless integration with M-PESA, and instant withdrawals, making it a compelling choice for many investors.

Also Read: Why Did Safaricom Launch the Ziidi (MMF) Money Market Fund?

Frequently Asked Questions(FAQs)

Is ZIIDI for individuals or can chamas and businesses invest?

As currently approved by the Capital Markets Authority, Ziidi is an individual investment fund, however, we are working to add other options in the near future which may bring in chamas and businesses.

Is ZIIDI halal compliant?

As currently approved, Ziidi is an interest earning money market, however we are working on a Shariah compliant option that will be unveiled soon.

What interest do I earn for investing in ZIIDI?

This is a Money Market Fund where the funds are invested in government securities such as T-bills as well as interest earning accounts. The rate therefore changes daily. The interest earned on your investments is computed daily and an indicated rate given to you on the M-PESA App and on *334#. Your funds start working for you just 24 hours after depositing. It’s the perfect way to make your money grow effortlessly!

Does Ziidi Interest attract a fund management charge?

Yes, the fund management fee is 2% interest per annum. However, the return indicated is a net return.

Is money earned on Ziidi subject to taxation?

Yes, like all other interest earning investments, Ziidi income is subject to 15% withholding tax.

Does Safaricom charge M-PESA transaction fee for using Ziidi?

No, all transactions to and from your M-PESA wallet to Ziidi Fund are completely free. Enjoy giving you a worry-free convenience to manage your money.

Can I deposit or withdraw funds from ZIIDI directly to an agent or to the bank account?

No, for now, all deposits and withdrawals are via your M-PESA account.

What is the transaction limit for ZIIDI?

The minimum amount to invest is KES 100 and the minimum amount you can withdraw is KES 10. There is no maximum investment in ZIIDI. However, the daily M-PESA transaction limit of KES.500,000 per day and KES. 250,000 per transaction are applicable.

How do I track my investment?

You can view and track your investment and earnings on the Ziidi mini app homepage under Investment performance or on *334#

What document should I provide for the next of Kin claims?

Next of Kin is the person whose details you update on ZIIDI and in the event of incapacities such as sickness, mental instability, or death they can have access to your funds.

In the event of a claim, the Next of Kin will provide the following documents:

- A duly filled ZIIDI Next of Kin claim of funds form.

- Identification document (ID)

- Death Certificate

- Grant of Probate/Letter of Administration

- Letter from local Administration ascertaining the heir.

Which channel should I use to make Next of Kin claims?

As a Next of Kin, you’ll be required to visit the nearest Safaricom Retail shop or Care Desk for assistance with processing the claim.

Can I change ownership of my ZIIDI Account to my Next of Kin?

You cannot change ownership of your Ziidi account. If you need to change the ownership of your Ziidi account, you will need to withdraw all your funds and opt out of Ziidi. Then, follow the current process for changing the ownership of your mobile number and account details. We are here to help you through each step!

What does it mean to lock Funds in ZIIDI?

- Locking funds in Ziidi Money Market Fund (MMF) is a smart way to set aside money and avoid unplanned spending.

- It adds an extra layer of safety and control, helping you stay on track with your financial goals.

- While the locked funds will not earn additional interest for now, you are taking a positive step towards financial discipline and security.

How long can I Lock my Funds?

There is no fixed period for locking your funds with Ziidi. Lock them for as long as you like using the Ziidi Mini-App on the M-PESA App or USSD 334#. Plus, you can easily top up your locked funds anytime.

When will my funds be available after un-locking?

Your funds will be available 72 hours after unlocking. Kindly note that you can only unlock the entire locked amount, not just a portion of it.

Is there a transaction limit for locking or unlocking funds?

No, there’s no limit to the amount that can be locked or unlocked. However, the amount to be locked should be less than or equal to the amount in the Ziidi wallet. No fees will be charged for locking and unlocking of invested funds.

Will the locked funds award higher interest than the rest of the funds in Ziidi?

The interest earned will be the same, however locking your funds helps you overcome impulsive spending building financial discipline.

Where do I get support for ZIIDI?

For support and inquiry, please contact Safaricom Customer Care Center

- Pre-Pay: Call 100 (Chargeable) or +254722002100 (Chargeable) or email Customercare@safaricom.co.ke

- Post-Pay: Call 200 (No Charge) or +254722002100 (Chargeable) or email advantage@safaricom.co.ke

- You can also send us a Direct Message on our Social Media Channels: X: @Safaricom_care and @safaricomPLC or Facebook: @safaricomPLC

- Visit the Safaricom Retail Center/ Customer Care Desk.

Ziidi and MALI FAQs

With the launch of Ziidi, will MALI also be onboarding new customers?

Both Ziidi and MALI are Money Market Fund products approved by the Capital Markets Authority (CMA) and available for investment. At the moment, MALI is not accepting new opt-ins.

Customers in the fund can continue to invest in Mali.

With the launch of Ziidi, will MALI also be onboarding new customers?

Both Ziidi and MALI are Money Market Fund products approved by the Capital Markets Authority (CMA) and available for investment. At the moment, MALI is not accepting new opt-ins.

Customers in the fund can continue to invest in Mali.

What will happen to MALI?

MALI continues operating and providing a return for those who are already in the fund allowing deposits and withdrawals.

Is my money safe in MALI?

MALI continues to operate and provide a return to its unit holders. A MALI customer can access their investments through M-PESA App MALI mini app or *334# to invest or withdraw funds

For any additional queries, kindly contact Safaricom Contact Center on 100 (Prepaid) /200 (Postpaid).