Over the last 10 weeks, Treasury bill (T-bill) rates in Kenya have been falling, sparking widespread debate and concern among investors. This trend has been driven by macroeconomic factors, policy adjustments, and shifts in market sentiment. We delve into the reasons behind this decline, its implications for investors, and what it means for the Kenyan economy.

Understanding Treasury Bills and Their Role in Kenya’s Economy

Treasury bills (T-bills) are short-term government securities that help the government manage its cash flow and fund public expenditure. In Kenya, T-bills are issued for three tenors:

- 91-day bills: Short-term, high-liquidity options.

- 182-day bills: A medium-term investment instrument.

- 364-day bills: One-year securities offering higher yields.

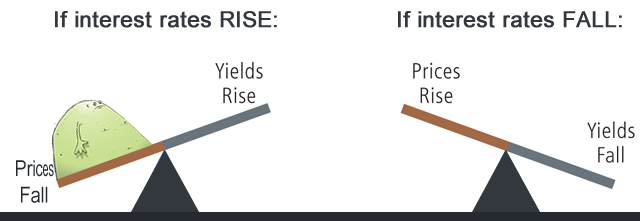

Investors bid on these bills, with yields determined by demand and prevailing market conditions. T-bills are considered low-risk because they are backed by the government, making them a favorite for risk-averse investors like banks, fund managers, and individuals seeking secure returns.

Key Trends in Treasury Bill Rates

Over the past 10 weeks, T-bill rates in Kenya have steadily declined, with recent data from the Central Bank of Kenya (CBK) showing the following changes:

- 91-day T-bill: Declined from 15.7844% to 15.7677%.

- 182-day T-bill: Fell marginally to 16.1795%.

- 364-day T-bill: Dropped to 16.8228%

These changes represent a significant shift in investor expectations and economic conditions.

Why Are T-Bill Rates Falling?

1. Improved Macroeconomic Conditions

Kenya’s inflation rate has stabilized at around 5%, within the government’s target range of 2.5%–7.5%. This stability has reduced pressure on the Central Bank to maintain high interest rates. Stable inflation typically leads to lower yields as investors demand less compensation for inflationary risks.

2. Monetary Policy Easing

In recent months, the CBK has adopted a more accommodative monetary policy to stimulate economic growth. A recent reduction in the Central Bank Rate (CBR) to 12.75% has had a cascading effect on Treasury bill rates. This policy move signals the government’s intent to lower borrowing costs and encourage investment in the private sector

3. Increased Liquidity in Financial Markets

Improved liquidity within the banking sector has reduced competition for government securities. With more funds available for lending and investment, banks are bidding less aggressively on Treasury bill, leading to a drop in yields.

4. Reduced Risk Premiums

Kenya has seen a decline in its economic risk indicators, such as political stability and favorable global market conditions. Lower risk premiums translate to lower yields as investors are willing to accept lower returns for perceived stability.

5. Global Market Trends

Global financial markets have experienced easing interest rates, especially in advanced economies like the U.S. and the Eurozone. This has influenced local rates, as the Kenyan government aligns its yields with global benchmarks to remain competitive.

Implications for Investors

1. Declining Yields on Investments

For institutional and individual investors, the falling T-bill rates mean reduced returns on short-term investments. Those relying on T-bills for steady income are likely to explore alternative investment avenues.

2. Shift Toward Alternative Investments

As T-bill yields decline, investors are increasingly considering other options like:

- Corporate bonds offering higher yields.

- Equities for potentially higher long-term returns.

- Real estate as a stable asset class.

3. Positive Effects on Borrowers

Lower T-bill rates signal reduced government borrowing costs, which may translate into more affordable loans for businesses and individuals. This can stimulate economic growth by encouraging investments in productive sectors.

4. Challenges for Fund Managers

Institutional investors managing pension funds and mutual funds may face challenges meeting return expectations, forcing them to rebalance their portfolios toward higher-risk assets.

Broader Economic Impact

1. Economic Growth

Lower interest rates can spur economic growth by making credit cheaper for businesses and individuals. This encourages expansion, job creation, and increased consumption.

2. Government Debt Management

The declining T-bill rates are a boon for the Kenyan government, as they reduce the cost of servicing domestic debt. This allows more resources to be directed toward development projects and social programs.

3. Boost to Investor Confidence

The trend reflects improving economic fundamentals, which can enhance investor confidence in Kenya’s financial markets.

Expert Opinions

Financial analysts suggest that the decline in Treasury bill rates is a double-edged sword. While it benefits borrowers and the government, it poses challenges for investors seeking safe, high-yield investments.

“The falling T-bill rates underscore Kenya’s improving macroeconomic stability, but investors must diversify to navigate this low-yield environment,” says an economist at a leading bank

Recommendations for Investors

1. Diversify Your Portfolio

Consider spreading investments across different asset classes like equities, real estate, and bonds to mitigate risks associated with falling yields.

2. Explore Long-Term Investments

Long-term instruments, such as infrastructure bonds, may offer higher yields and stability.

3. Stay Updated on Policy Changes

Keep an eye on monetary policy adjustments and macroeconomic trends to make informed investment decisions.

Also Read: World Bank Cuts Kenya’s Growth Projection to 4.7%

The 10-week decline in Treasury bill rates in Kenya highlights a turning point in the country’s economic trajectory. While the trend benefits borrowers and the government, it challenges investors to adapt to a low-yield environment. By understanding the underlying factors and implications, stakeholders can navigate these changes effectively and make strategic decisions for the future.

FAQs

What are Treasury Bills (T-bills)?

Treasury Bills (T-bills) are short-term government securities issued to finance public expenditure. They are typically issued for three durations: 91-day, 182-day, and 364-day periods. T-bills are considered a low-risk investment because they are backed by the government.

Why have T-bill rates been falling in Kenya?

The decline in T-bill rates is attributed to factors like improved macroeconomic stability, reduced inflation, monetary policy easing, increased liquidity in financial markets, and alignment with global financial trends.

How do falling T-bill rates affect investors?

Lower T-bill rates mean reduced returns for investors, particularly those seeking safe and steady income streams. Investors may need to diversify into other asset classes such as corporate bonds, equities, or real estate to maintain portfolio performance.

What are the benefits of falling T-bill rates for the Kenyan economy?

Falling T-bill rates reduce the government’s borrowing costs, enabling more funds to be allocated to development projects and public services. They also lower borrowing costs for businesses and individuals, stimulating economic growth.

What alternatives should investors consider when T-bill rates fall?

Investors can explore options like:

- Corporate bonds for higher yields.

- Equities for long-term capital appreciation.

- Real estate investments for stable returns.

- Mutual funds or REITs for diversified exposure.

How are T-bill rates determined?

T-bill rates are determined by demand and supply during auctions conducted by the Central Bank of Kenya. Other influencing factors include macroeconomic conditions, inflation, and monetary policy.

Will T-bill rates rise again?

The trajectory of T-bill rates depends on macroeconomic developments, government borrowing needs, and monetary policy adjustments. A rise in inflation or tighter monetary policy could push rates higher in the future.

What is the impact of global financial trends on Kenya’s T-bill rates?

Global trends, such as easing interest rates in advanced economies, influence local rates. Kenya aligns its yields with global benchmarks to remain competitive and attract foreign investors.

How do falling T-bill rates benefit borrowers?

Lower T-bill rates translate to reduced government borrowing costs, which can lead to lower interest rates for loans issued by commercial banks, benefiting businesses and individuals seeking credit.

Are T-bills still a good investment in a low-yield environment?

T-bills remain a secure investment option, especially for risk-averse investors. However, in a low-yield environment, diversification into higher-yielding assets may be necessary for better returns.