Building assets is a cornerstone of financial independence, as emphasized by Robert Kiyosaki in his globally renowned Rich Dad, Poor Dad. His approach simplifies wealth creation, urging individuals to focus on acquiring income-generating assets over liabilities. We delve into actionable steps to create and grow your asset portfolio using Kiyosaki’s proven principles.

1. Understanding the Concept of Assets

Before diving into asset creation, it’s crucial to differentiate assets from liabilities. According to Kiyosaki, assets are anything that puts money in your pocket, such as rental properties, stocks, or businesses, whereas liabilities take money out. This foundational understanding is pivotal for financial success.

2. Types of Assets You Can Create

Kiyosaki categorizes assets into several types:

- Real Estate: Investing in properties for rental income or appreciation.

- Paper Assets: Stocks, bonds, mutual funds, and ETFs that grow wealth through dividends or capital gains.

- Businesses: Owning or investing in businesses with scalable income potential.

- Commodities: Precious metals, oil, or agricultural products that hold intrinsic value.

- Intellectual Property: Royalties from books, patents, or creative works.

By diversifying your asset classes, you mitigate risks while optimizing returns.

3. Key Steps to Start Building Assets

A. Financial Literacy

Knowledge is your best investment. Kiyosaki advocates for continuous learning about money, markets, and investment strategies. Resources like books, online courses, and financial mentors are invaluable.

B. Budgeting for Asset Acquisition

Track your income and expenses to allocate funds toward acquiring assets. Start small, such as purchasing a single stock or investing in an index fund, and scale up as your financial acumen improves.

C. Leveraging Debt Wisely

Not all debt is bad. Kiyosaki emphasizes using “good debt” to acquire income-generating assets. For example, a mortgage on a rental property can yield positive cash flow when managed effectively.

D. Embracing Entrepreneurship

Starting a business aligns with Kiyosaki’s asset-building philosophy. Focus on ventures that offer scalability and passive income opportunities, such as online businesses or franchising.

4. Overcoming Challenges in Asset Building

Fear of Risk: Start with low-risk investments to build confidence.

Lack of Capital: Explore alternative funding methods, such as crowdfunding or partnerships.

Market Fluctuations: Diversify your investments to hedge against economic downturns.

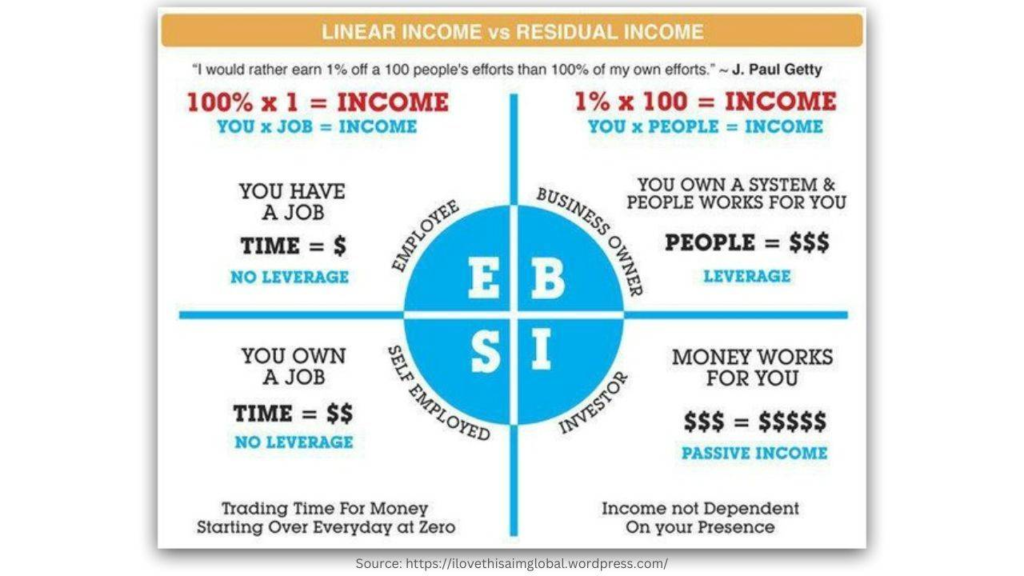

5. The Power of Passive Income

Passive income is a recurring theme in Kiyosaki’s teachings. It allows you to decouple time from earnings, enabling financial freedom. Examples include rental properties, dividends, and automated businesses.

6. Technological Tools for Asset Management

Leverage technology to manage your assets effectively. Platforms like stock trading apps, real estate investment tools, and blockchain-based asset tokenization democratize access to wealth creation opportunities.

7. Real-Life Success Stories

Individuals across the globe have implemented Kiyosaki’s principles with remarkable success. For instance, small-scale investors in Kenya are using savings groups (chamas) to pool resources for real estate projects, aligning with Kiyosaki’s emphasis on collaborative asset-building strategies.

8. Your Action Plan for Asset Creation

- Set Clear Financial Goals: Define your “why” and your financial targets.

- Start Small: Begin with manageable investments and scale up gradually.

- Network: Join communities of like-minded individuals for shared learning and opportunities.

- Review and Adjust: Regularly evaluate your portfolio to align with your goals.

FAQs

What is an asset according to Robert Kiyosaki?

An asset, as defined by Robert Kiyosaki, is anything that puts money into your pocket. Examples include rental properties, stocks, businesses, and intellectual property.

How can I start building assets with limited capital?

Start small by investing in affordable assets like ETFs or micro-investments in real estate through REITs. Gradually reinvest your earnings to grow your portfolio.

What’s the difference between assets and liabilities?

Assets generate income or appreciate in value, adding to your wealth. Liabilities, on the other hand, incur costs and reduce your net worth.

Why does Kiyosaki emphasize financial education?

Financial education helps individuals make informed decisions, identify opportunities, and avoid common mistakes in investing and wealth creation.

How do I use “good debt” to build assets?

Good debt involves borrowing to acquire income-generating assets, such as taking a mortgage to buy rental properties. The income from the asset should exceed the debt repayment.

What is passive income, and why is it important?

Passive income is money earned without active effort, such as rental income or dividends. It’s essential for achieving financial freedom as it allows you to earn even when not actively working.

Can I build assets without starting a business?

Yes, you can invest in other types of assets like stocks, bonds, or real estate. While starting a business can enhance asset growth, it’s not the only route.

How does diversification reduce risk?

Diversification spreads your investments across different asset types, industries, or regions. This minimizes the impact of losses in any one area, safeguarding your overall portfolio.

What tools can help me build assets?

There are various tools, such as stock trading apps (e.g., Robinhood), real estate platforms, and financial management software (e.g., Mint or YNAB) to track and optimize your investments.

How can I sustain asset growth over time?

Reinvest your earnings, stay updated on market trends, and continuously educate yourself about financial strategies to ensure long-term asset growth.

Also Read: Understanding Assets vs. Liabilities: The Key to Financial Freedom

Robert Kiyosaki’s principles on how to build assets are timeless. By focusing on assets that generate income and embracing financial education, you can achieve financial freedom. Whether you’re just starting or expanding your portfolio, the key is consistency and a willingness to learn.

Start building your asset base today, and let your money work for you.