Urban development requires huge resources, prudent planning, and a well-thought-out vision for sustainable growth. With the rapid population growth, cities in Africa and the world over are stretching infrastructure, housing, and essential services to the breaking point. Public-Private Partnerships indeed have emerged as a robust tool in bridging the gap between public needs and private investment capabilities. As such, these partnerships play the leading role in financing large-scale urban projects by assuring fund availability and facilitating efficient project management and innovation.

Knowclick media will interpret the financial mechanisms motivating PPPs in urban development, their contribution to sustainable growth. Why they are important in addressing the urbanization challenge in Africa, particularly focusing on Kenya.

The Role of Public-Private Partnerships in Urban Development

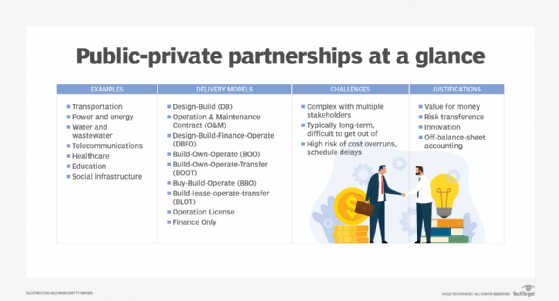

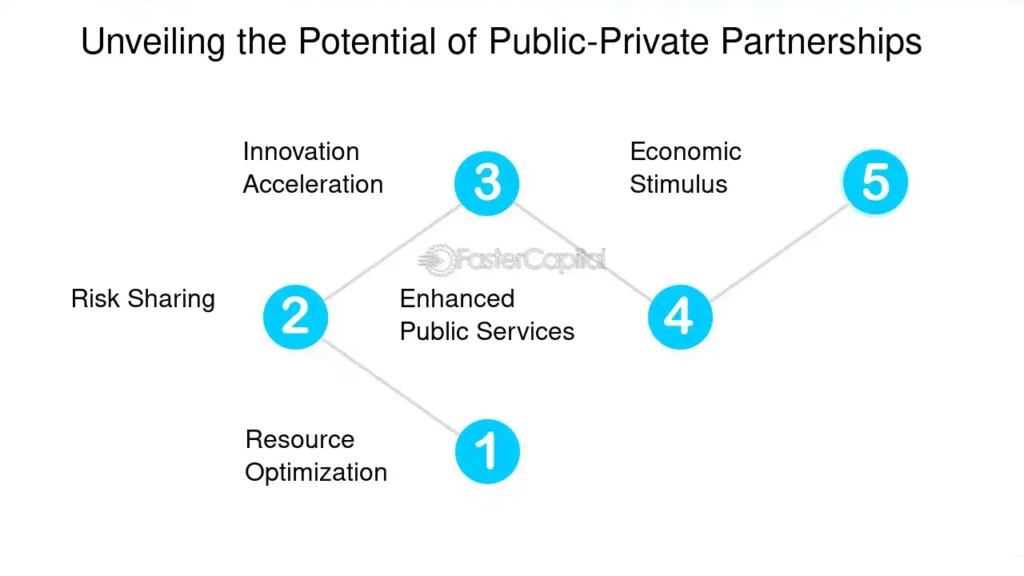

The PPPs combine the best of both worlds-the strengths of the public and private sectors. The governments provide overall regulatory oversight, land, and sometimes initial capital, while the private sector contributes innovation, efficiency, and much-needed funding to so many projects, including transportation infrastructure, reasonably priced housing, and other smart city initiatives.

Examples of such successful collaboration between the public and private sectors include Kenyan cities such as Nairobi and Mombasa. The partnerships stimulate growth and improve some of the urban challenges at the growing cities. However they can only succeed if they are based on a well-drawn out financial agreement, which is inclusive of the level of responsibility, risk-sharing models, and profit margins.

Mechanisms for Financing PPPs for Urban Development

A major advantage with PPPs is access to varied financing mechanisms that would otherwise not be accessible to public institutions. The most frequent financing structures include:

1. Municipal Bonds

Municipal bonds are debt securities issued by local authorities for the financing of public projects. These have emerged as a viable option for raising finances for urban development in Kenya. The bonds are needed for long-term financing of PPP projects and provide investors with low-risk investment opportunities.

2. Green Bonds

Green bonds are financial instruments designed to fund projects that have positive environmental and climate benefits. These bonds are increasingly popular in financing urban infrastructure that focuses on sustainability, such as eco-friendly housing, renewable energy installations, and water management systems.

3. Real Estate Investment Trusts (REITs)

Through REITs, private investors have had the means of pooling resources and investing in income generative real estate projects. In Kenya, REITs have driven urban development. They have largely influenced the reaction of the urban area to the rise in demand for house supply. By integrating REITs into the structures of PPPs, private investors secure the flow of capital in developing the urban regions.

4. Public Financing

Public finance is needed in most PPPs, either by the way of grant from the government or appropriation of budget. Normally, this would cover the planning of a project, early development, or gap funding when purely private finance may not be sufficient.

5. International Development Finance

International development agencies such as the World Bank and AfDB play the critical role of providing finances for the PPP projects in Africa through the provisions of loans, guarantees, and grants that derisk the large urban development initiatives.

Effective Risk Mitigation in ppp projects

Successful PPPs are based on a mutual understanding of the allocation of risk. Urban development projects are enveloped by sources of risk. They include, but are not limited to, the following: changes in government policy, fluctuating interest rates, delays in construction, shifts in market demand.

1. Regulatory Risks

Changes in government policy or delays in regulatory approval from the relevant authority also create difficulties for PPPs. For such risk, a good legal framework is required as mitigant. In Kenya, for example, this has been made possible through the. Public-Private Partnerships Act, 2013, laying a very sound regulatory framework for PPP projects.

2. Market Risks

Therefore, these projects are exposed to market risk factors; for instance, real estate development projects would not be profitable if there were no persons to buy the houses or if it were not tenable. Thus, the financial models like REITs and blended finance structures that ensure investors get their money back even in an ever-changing environment remove such risks. Construction and Operational Risks

Construction delays, cost overruns, or operational inefficiencies are to a large extent deterministic of the success of such a project. Usually, this kind of risk is taken by private partners who have every motive to see the project completed on time and within the budget. Some common risk mitigation strategies include penalties for non-performance and insurance against unforeseen events.

How PPPs Drive Affordable Housing

While PPPs present an effective solution to a number of pressing urban development challenges in Africa, affordable housing is high up on the agenda. By combining public land with private investment, governments reduce the cost of housing projects to levels where access to home ownership becomes more feasible and affordable for low- and middle-income families.

The financial viability of affordable housing projects often requires subsidies, tax incentives, and innovative financing models, such as REITs or government-backed mortgage schemes. These mechanisms help extract a reasonable return by the private investor while meeting the social objectives.

Role of PPPs in Smart City Development

While many African cities are on their way to becoming urbanized, there is a greater need for infrastructure related to smart cities. In this regard, a smart city infrastructure will involve advanced technologies in traffic management systems, energy-efficient buildings and integrated communication networks to make life in cities better. The primary reason PPPs have been very instrumental in improving these technologies on a large scale is due to the increased capital and expertise required.

Several sustainable transport systems, energy-efficient infrastructures, and data management systems are some of the key areas in which PPPs have been used in developing smart cities. Initiatives like this require large upfront investments that may be availed through PPPs together with technological knowhow.

The Future of Public-Private Partnerships in Kenya’s Urban Development

Emerging trends in Kenya’s urbanization indicate that PPPs are going to be a continuing influence in the development of its cities. In this respect, the private sector is very critical in providing much-needed capital, technologies, and expertise that will help the government achieve its ambitious infrastructure and housing targets. Indeed, the adoption of innovative financing instruments, such as municipal bonds, green bonds, and REITs among others, holds considerable prospects for unlocking substantial investments in urban development.

But transparency, effective risk management, and clear regulatory frameworks are important for the long-term success of PPPs. Where these conditions exist, Kenya can realize urban environments that are economically thriving, socially inclusive, and environmentally sustainable.

________________________________________

Frequently Asked Questions

1. What are Public-Private Partnerships in Urban Development?

PPPs in urban development refer to governments partnering with the private sector to finance, develop, and manage or operate urban infrastructure and housing projects.

2. How are PPPs used to finance urban development?

PPPs enable access to different financing methods: municipal bonds, green bonds, and REITs. These financial structures lighten the burden on governments and create opportunities for private investors to contribute to city growth.

3. What is the function of green bonds in urban development?

Green bonds finance projects that don’t harm the environment. In urban development-for example-they can support the infrastructure which would reduce any impact on the environment and, therefore, would contribute to sustainable city growth.

4. What are the major risks in PPP urban development projects?

Common ones include regulatory delays, market fluctuations, construction setbacks, and operational inefficiencies. Appropriate managing strategies used tame these risks.

5. How do PPPs impact affordable housing in Kenya?

PPPs generally help in the development of affordable housing through the combination of public land and private investment with accruable benefits from subsidies, tax incentives, and innovative financing models.

6. What is the future of PPPs in Kenya’s urban development?

As such, PPPs are set to continue playing a critical role in addressing Kenya’s infrastructure and housing needs. Equipped with strong financial strategies coupled with regulatory frameworks, it can potentially catalyze sustainable urban growth.

Also Read: Affordable Housing Solutions in Kenya

Through innovative finance strategies and the building of relationships. This PPP will be important in continued responses throughout Kenya and Africa as they face challenges with urbanization.